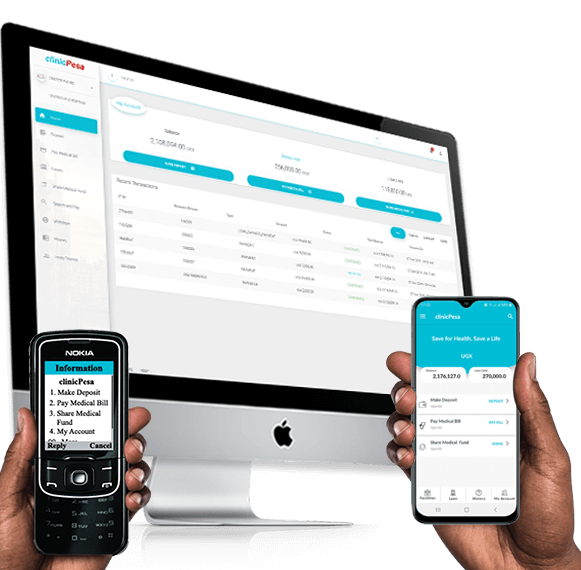

Why  ?

?

We believe, "No one should be denied access to health care because they can not afford it".

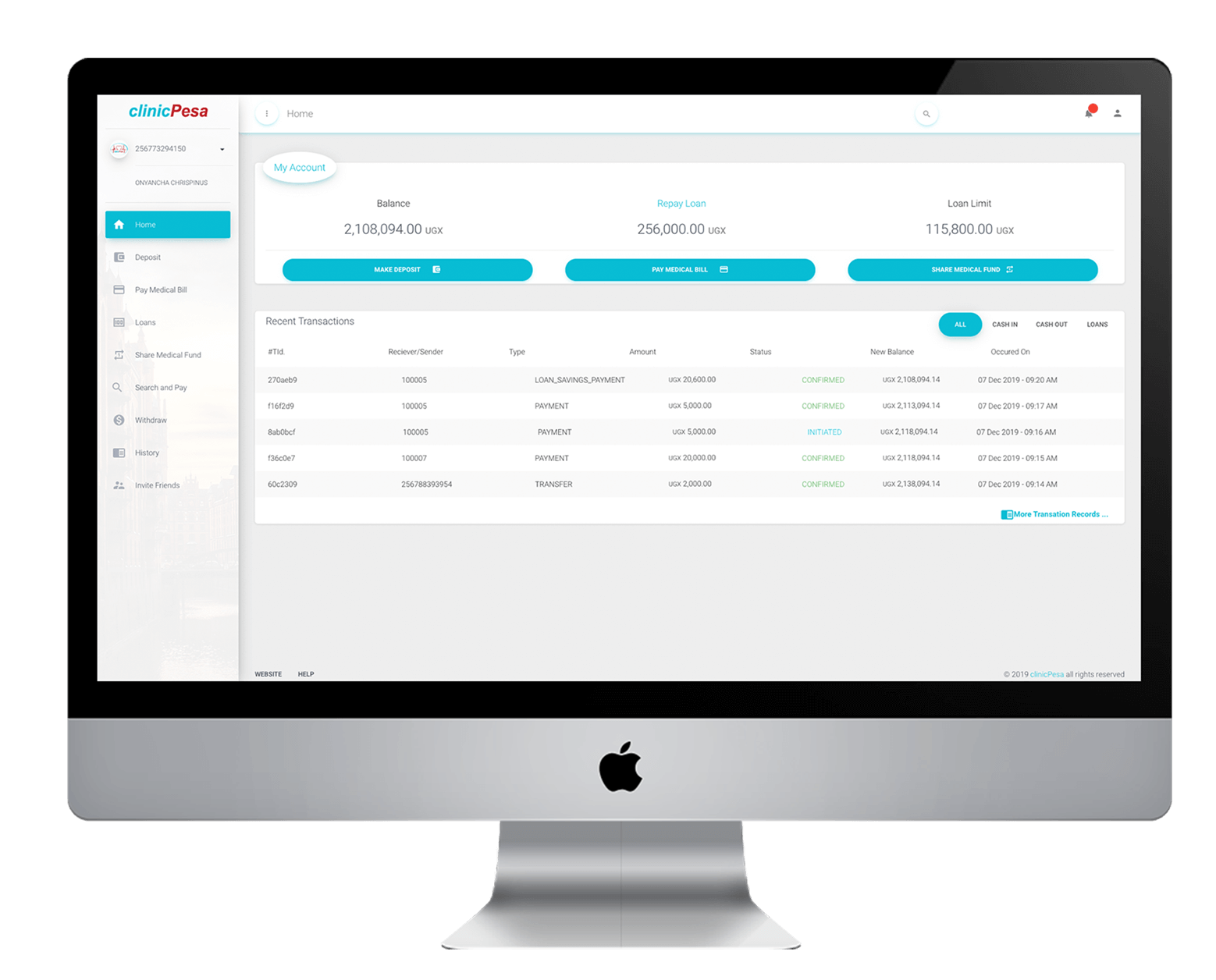

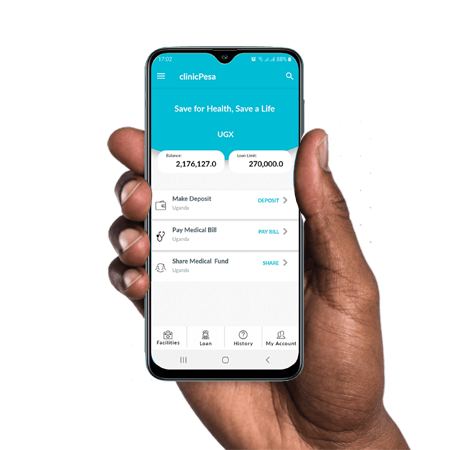

provides

you with access to healthcare financing,

provides

you with access to healthcare financing,

that is more convenient and affordable than the traditional

Insurance,

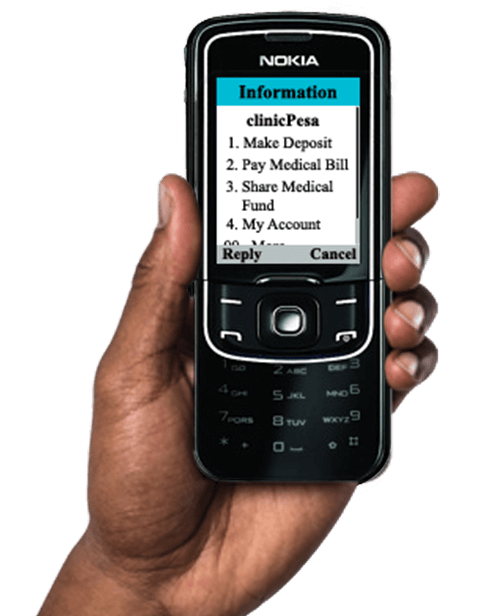

through a digital micro-loans and savings platform for setting

aside dedicated healthcare funds used to offset medical bills and

purchase drugs in time of need at our registered clinic, hospital

or pharmacy.